dependent care fsa limit 2021

The maximum percentage of your work-related expenses allowed as a credit for 2021 is 50 percent. The IRS increased the limit for.

New 2022 Brochure For Dependent Care Assistance Plan Fsa Benefit Plan Document Core Documents

For 2021 the contribution limit is 2750.

. The money that you contribute to the account lowers your taxable income for the year but you must use DCFSA funds within a certain period of time. The new DC-FSA annual limits for pretax contributions increases to 10500 up from 5000 for single. The employee incurs 15500 in dependent care expenses in 2021 and is reimbursed 15500 by the DC FSA.

Dependent Care Tax Credit. This was part of the American Rescue Plan. Included in the changes was the one-time change to the contribution limit for dependent care FSAs thats to say the contribution limit is not permanently changed but changed for 2021 only.

The American Rescue Plan Act of 2021 has affected both continuation coverage and the limit for dependent care FSAs. Typically if you dont spend your Dependent Care FSA funds by the end of the year you lose that money. The 2021 Instructions for Form 2441 and IRS Publication 503 Child and Dependent Care Expenses for 2021 both will contain a chart indicating the percentage of work-related expenses allowed as a credit at each income level.

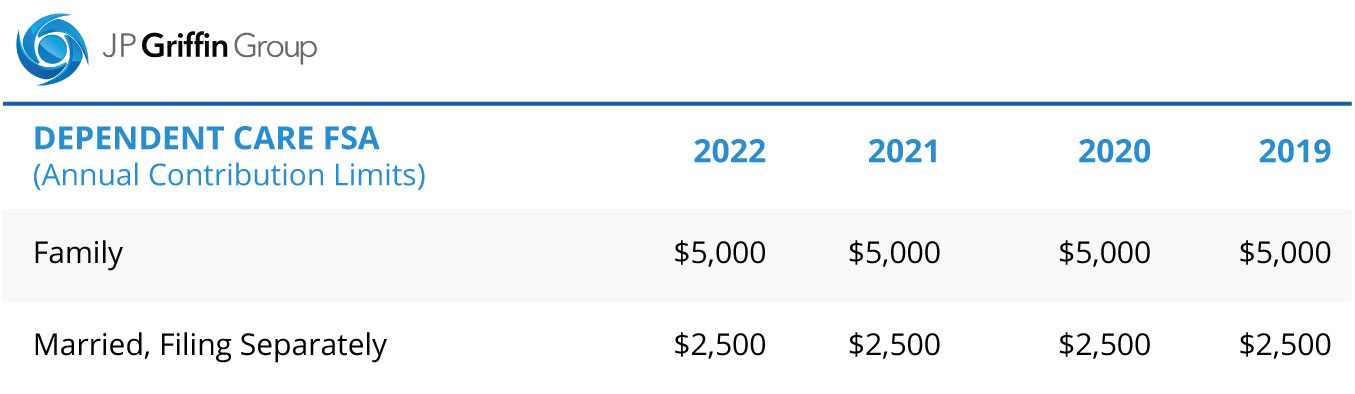

Employers can choose whether to adopt the increase or not. The limit will return to 5000 for 2022. The Consolidated Appropriations Act of 2021 allows some Dependent Care FSA plan participants to file claims for their eligible dependent care expenses for children through the end of the plan year in which the child turns 13 rather than the standard IRS provision of only to the 13th birthday.

Effective immediately you may newly enroll or increase your existing election for the Dependent Care Flexible Spending Account FSA through the Missouri State Employees Cafeteria Plan MoCafe. It also increases the value of the dependent care tax credit for 2021. 214 of the Taxpayer Certainty Disaster Tax Relief Act.

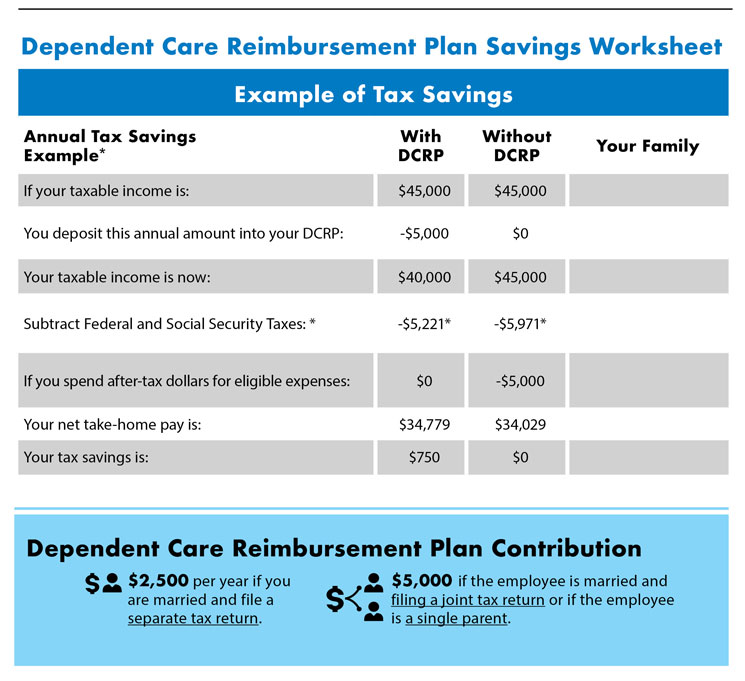

Will a Dependent Care FSA save you money. On March 11 2021 The American Rescue Plan Act of 2021 ARPA was signed into law by President Biden. A dependent care FSA DCFSA allows qualified individuals to pay for child and dependent care expenses completely tax-free up to a certain limit.

If a child turned 13 in the 2020 plan year AND the participant rolled over funds into. The law increased 2021 dependent-care FSA limits to 10500 from 5000 offering a higher tax break on top of existing rules allowing more time to spend the money. The 15500 is excluded from the employees gross income and wages because 10500 is excluded as 2021 benefits and the remaining 5000 is attributable to a carryover permitted under Sec.

WASHINGTON The Internal Revenue Service today issued guidance on the taxability of dependent care assistance programs for 2021 and 2022 clarifying that amounts attributable to carryovers or an extended period for incurring claims generally are not taxable. The American Rescue Plan Act of 2021 ARPA which was enacted on March 11 2021 temporarily increases the maximum amount that an employee is permitted to contribute to a dependent care. Thanks to the American Rescue Plan Act single and joint filers could contribute up to 10500 into a dependent care FSA in 2021 and married couples filing separately could contribute 5250 up from 2500.

ARPA allows employers to increase the annual limit on contributions to dependent care FSAs up to 10500 for the 2021 plan year only. The guidance also illustrates the interaction of this standard with the one-year increase in the. Employers may allow participants to carry over unused amounts IR-2021-40 February 18 2021 WASHINGTON The Internal Revenue Service today provided greater flexibility due to the pandemic to employee benefit plans offering health flexible spending arrangements FSAs or dependent care assistance programs.

If your employer offers a health FSA they most likely also offer a dependent care FSA flexible spending account. Dependent care FSA increase to 10500 annual limit for 2021. In 2021 the Dependent Care FSA limit was increased to 10500 for single taxpayers and married couples filing jointly and to 5250 for married individuals filing separately.

Prior to the American Rescue Plan Act of 2021 the Dependent Care Tax Credit provided a maximum of 35 of eligible childcare expenses paid during the year as a tax credit. The most money in 2021 you can stash inside of a dependent-care FSA is 10500. The limit for dependent care flexible spending accounts has been stuck at 5000 since the accounts inception in the 1980s.

FSA contributions cannot be returned in cash. But a new bill from Congress passed last week and is changing that. On March 16 2021.

Like its sister health FSA a dependent care FSA saves you money by allowing you to set aside money from your paycheck pre-tax. The new contribution limit is 10500 for 2021 for single taxpayers and married filing jointly a limit that was previously set at 5000 per year.

Dependent Care Open Enrollment 24hourflex

Dependent Care Open Enrollment 24hourflex

Coh Dependent Care Reimbursement Plan

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

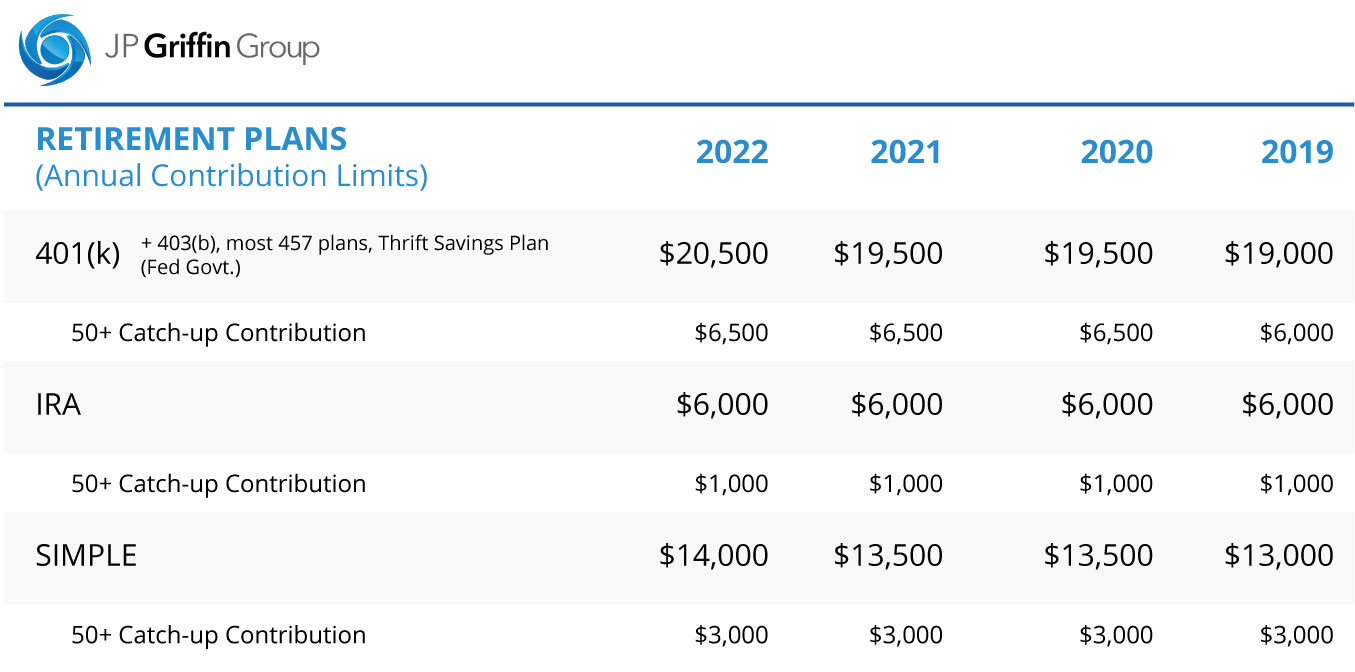

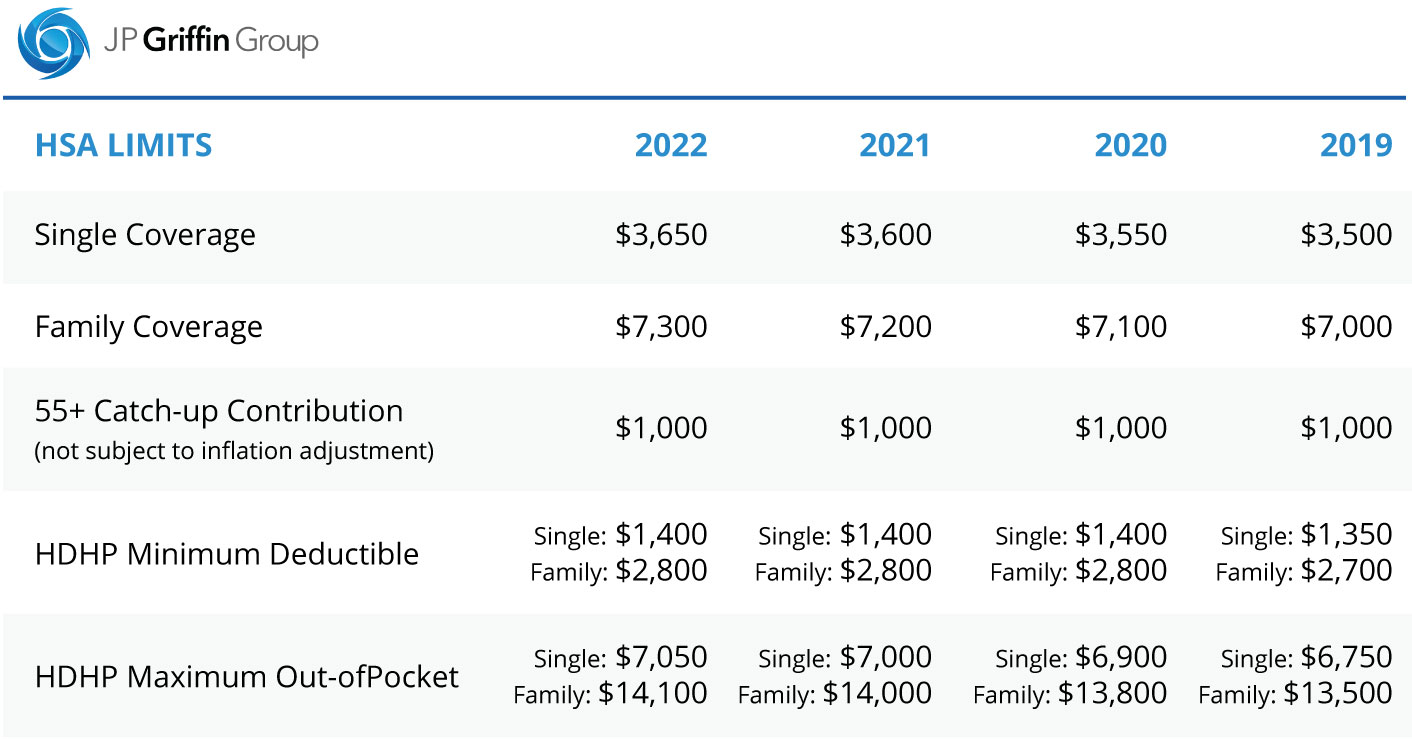

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Receipts For Child Care 2 Per Page Daycare Home Daycare Starting A Daycare

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

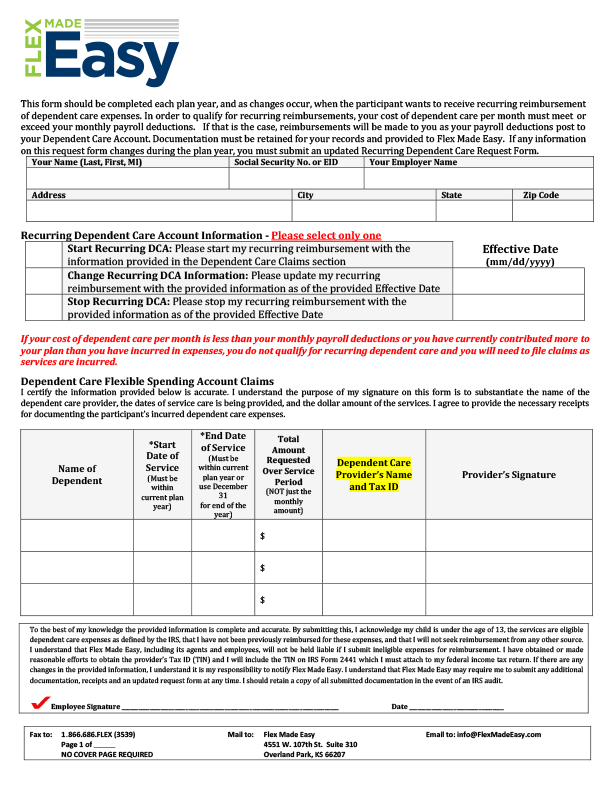

Dependent Care Flexible Spending Accounts Flex Made Easy

2021 Year Planner Hra Consulting Photo Yearly Planner Calendar Examples Planner

Dependent Care Account American Fidelity

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

What Is A Dependent Care Fsa Wex Inc

Cobra Subsidies Fsa Dependent Care Increase And Benefit Extensions From Arpa Navia

Dependent Care Fsa Outdoor Activities For Kids Free Things To Do Kids Pictures

Dependent Care Fsa Dcfsa Optum Financial

What Is A Dependent Care Fsa Wex Inc

Using A Dependent Care Fsa To Reimburse Childcare Costs In 2022

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning